30+ Debt to income ratio for house

Borrowers with low debt-to-income ratios have a good chance of qualifying for low mortgage rates. Monthly debt payments monthly gross income X 100 DTI ratio For example your income is 10000 per month.

Jim Fishinger On Linkedin What Do Mortgage Lenders Look For 1 Creditworthiness Including

F Participation in the paycheck protection program--In an agreement.

. To what extent is each local stakeholder involved in the partnership with emerging partners. Η Κρίση it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property as well as a small-scale humanitarian crisis. 50 for needs 30 for wants and 20 for savings or paying off debt.

Your mortgage property taxes and homeowners insurance is 2000. Interest only loans were particularly wound back with approvals limited to 30 per cent of a lenders total loan book. All six being multinationals.

Mortgage lenders want potential clients to be using roughly a third of their income to pay off debt. Of course the lower your debt-to-income ratio the better. Your debt-to-income ratio also determines whether youre eligible for the type of loan you want and improving your DTI can help you get lower mortgage rates.

Making major life purchases such as a house comes with a hefty price. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. In general the lower the percentage the better the chance you will be able to get the loan or line of credit you want.

Your credit utilization is the ratio of your total credit to your total debt and is usually expressed as a percentage. Africas post-HIPC debt external debt in percentage of GDP 1995-2009 Figure 612. A debt-to-income ratio DTI or loan to income ratio LTI is a way for banks to measure your ability to make mortgage repayments comfortably without putting you in financial hardship.

In all the Greek economy suffered the longest. Simply put the higher your debt-to-income ratio the more the lender. According to the Bureau of Labor Statistics a house purchased in 1967 for 100000 would have cost nearly 681000 in 2006.

Most lenders look for a ratio of 36 or less although there are exceptions. Lenders will also look at your debt-to-income ratio or DTI to get a clear picture of how risky it is to loan you money. Cost of living.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. 636a is amended-- 1 in paragraph 2-- A in subparagraph A in the matter preceding clause i by striking and E and inserting E and F. The basic rule of thumb is to divide your monthly after-tax income into three spending categories.

The 503020 rule is an easy budgeting method that can help you to manage your money effectively simply and sustainably. This costs a large portion of your income and takes many years to pay back. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

This includes credit card bills car. To afford the expensive cost most people typically apply for financing to buy a house. Greece faced a sovereign debt crisis in the aftermath of the financial crisis of 20072008Widely known in the country as The Crisis Greek.

When youre buying a house your debt-to-income ratio influences the size of the loan and the interest rate youll qualify for. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and. Borrowers with a high DTI ratio may have a high credit utilization ratio which accounts for 30 percent of your credit score.

There are two kinds of DTI ratios front-end and back-end which are typically shown as a percentage like 3643. If your credit utilization ratio is 25 percent it means youre using 25. Current Redmond 30-YR Fixed Mortgage Rates.

For instance if your debt costs 2000 per month and your monthly income equals 6000 your DTI is 2000 6000 or 33 percent. If it appreciates 4 a year that initial 235000 investment will be. But theres more to this ratio than meets the eye.

A low debt-to-income ratio demonstrates a good balance between debt and income. Peaking in November 2006. A house and land package loan or.

70 billion 23 January 2017 2010 est. Shows what portion of your income is needed to cover all of your monthly debt obligations plus your mortgage payments and housing expenses. And B by adding at the end the following.

The loan is secured on the borrowers property through a process. The loans have repayment terms of three to 72 months. A mere six compose more than 30 of all of Puerto Ricos corporate income tax collections.

The ideal debt-to-income ratio for aspiring homeowners is at or below 36. To determine your DTI ratio simply take your total debt figure and divide it by your income. Lenders calculate your debt-to-income ratio by dividing your monthly debt obligations by your pretax or gross income.

Divide 900 by 3000 to get 30 then multiply that by 100 to get 30. It possesses the highest ratio of students from the island that enroll in graduate studies. Lowering your credit utilization ratio will help boost.

Improving Your Financial Profile. The debt-to-income ratio is an underwriting guideline that looks at the relationship between your gross monthly income and your major monthly debts giving VA lenders an insight into your purchasing power and your ability to repay debt. Anything over a 43 debt-to-income ratio is a red flag to potential lenders.

By regularly keeping your expenses balanced across these main spending. Generally your total debt including mortgage payments shouldnt exceed 30 to 40 percent of your monthly incomeA range of factors must be weighed before any home-buying decision can be made. Take the first step toward the right mortgage.

A In General--Section 7a of the Small Business Act 15 USC. You must earn an after-tax income of at least 1000 per month to be eligible. When your 30-year mortgage is paid off.

A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the money borrowed. This means your DTI is 30. And mortgage lenders will often have in-house caps on DTI ratio that can vary depending on the borrowers.

An MMM-Recommended Bonus as of August 2021.

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Pin On Life After College

What Bills Are Calculated In The Debt To Income Ratio Quora

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Business Balance Sheet Template Free Download Balance Sheet Template Statement Template Business Letter Template

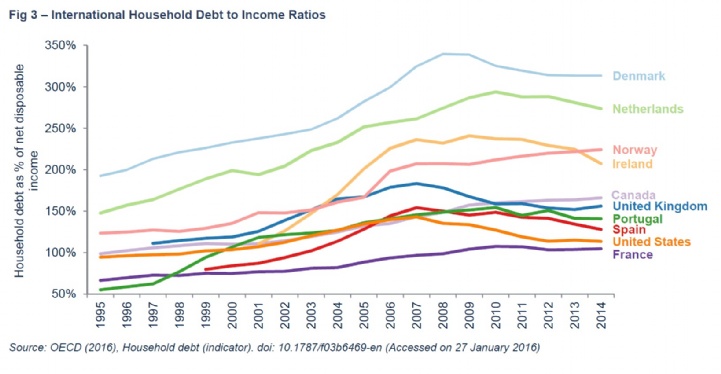

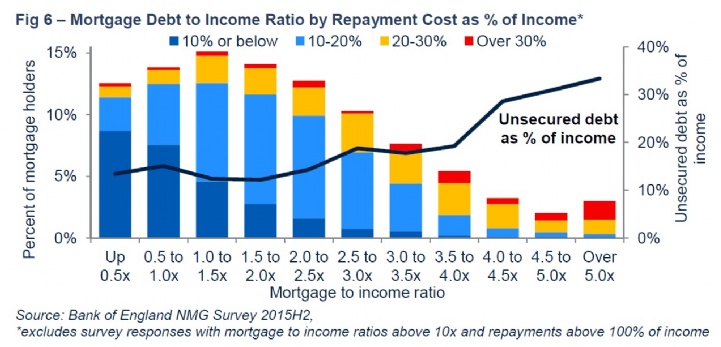

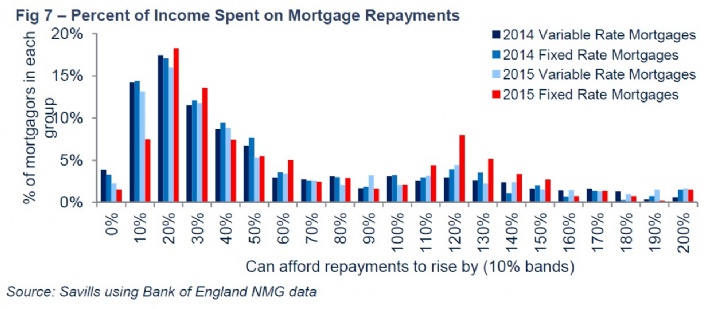

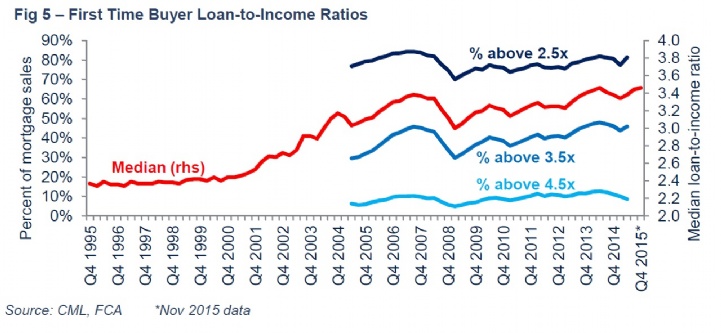

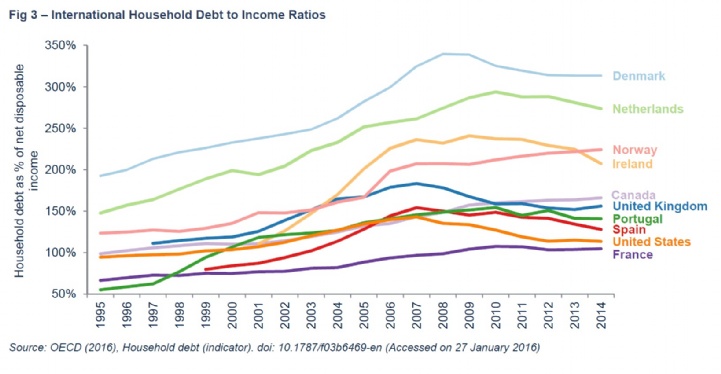

Savills Household Debt

Savills Household Debt

Pin On Best Of One Mama S Daily Drama

Savills Household Debt

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

What Is The Debt To Income Ratio And Why Is It Important Quora

Pin On Airbnb

Savills Household Debt

Pin On The Bear S Den

.jpg)

Savills Household Debt

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

1 Stop Mortgage First Time Home Buyers Mortgage Real Estate Values